With ‘dirty cash’ recognized as a medium for transmitting COVID-19 the general curtain is slowly final on money cost – clearing the way in which for some other stellar upward thrust in contactless cost.

For a very long time money has been king within the Vending marketplace, alternatively with innovation in contactless cost era and corresponding enlargement in client adoption, momentum has frequently grown against a time within the close to long run when the vast majority of merchandising machines simplest take contactless cost.

That used to be in a global ahead of COVID-19, a Global disaster the likes of which few folks have skilled and none will ever need to revel in once more. Though money use used to be predicted to say no over the approaching years, COVID-19 has catalysed an acceleration on this decline, due principally to findings by way of Scientists that ‘infected’ money used to be inflicting human to human transmission of the illness.

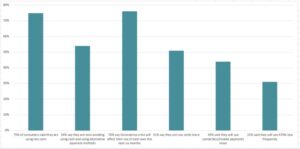

LINK ATM has undertaken weekly client analysis with YouGov since early March to know the way buying groceries behavior and money cost has modified throughout the COVID-19 pandemic. The conclusions are stark for retail and hospitality services and products the place there’s nonetheless a dependency on money cost. Alongside the estimated 50% of customers who now not raise money, the findings level against an additional vital shift in the usage of contactless cost by way of the 50% of customers who nonetheless do raise money.

LINK ATM has undertaken weekly client analysis with YouGov since early March to know the way buying groceries behavior and money cost has modified throughout the COVID-19 pandemic. The conclusions are stark for retail and hospitality services and products the place there’s nonetheless a dependency on money cost. Alongside the estimated 50% of customers who now not raise money, the findings level against an additional vital shift in the usage of contactless cost by way of the 50% of customers who nonetheless do raise money.

COVID-19 has speeded up client adoption of contactless

To minimise non-public possibility and save you additional transmission of the virus, extra customers than ever utilised contactless throughout the pandemic and with that behaviour firmly established in the previous few months are not going to go back to cost the use of money. The government additionally performed their section by way of expanding the contactless cost prohibit from £30 to £45 on 1stApril 2020 thus encouraging customers to go for contactless transactions slightly than delivering money.

Stephen Jones, leader government of UK Finance commented: “The bills business has been operating carefully with outlets so as to build up the contactless cost prohibit to assist shoppers with their buying groceries at this important time for the rustic.

“This will give more people the choice to opt for the speed and convenience of purchasing goods using their contactless card, helping to cut queues at the checkout.”

Although expanding the spending prohibit in itself will not be related to merchandising, it’ll foster a favorable and lasting trade in client behaviour and attitudes that can in the end boost up the adoption of contactless cost to the level that it’ll turn out to be the de-facto cost approach for all transactions. Hard money in its present shape will merely be not able to live to tell the tale this elementary shift in client behaviour.

Consumers are rejecting ‘dirty cash’ – with contactless the transparent winner

In a up to date Mastercard survey centered at the implications of the coronavirus pandemic, 82% of respondents international now view contactless because the cleaner approach to pay, and 74% state they’ll proceed to make use of contactless cost post-pandemic.Some even have shyed away from taking flight or dealing with doubtlessly grimy money all in combination, with ATM transactions down by way of over 60% since lockdown started.

In a up to date Mastercard survey centered at the implications of the coronavirus pandemic, 82% of respondents international now view contactless because the cleaner approach to pay, and 74% state they’ll proceed to make use of contactless cost post-pandemic.Some even have shyed away from taking flight or dealing with doubtlessly grimy money all in combination, with ATM transactions down by way of over 60% since lockdown started.

Today customers are frightened because of considerations that money dealing with is grimy and could also be otherwise the coronavirus will also be transmitted and unfold. The retail business has accentuated this hysteria with many stores and supermarkets refusing to just accept money bills, providing card transactions simplest.

“I know a lot of merchants are putting signage up at the point of sale, ‘Please use contactless” mentioned Linda Kirkpatrick, a Mastercard government who works with banks and credit score unions.

This trade in client behaviour and angle against money, blended with concerted efforts by way of outlets and banks to power customers against contactless cost, has main implications for merchandising in that merchandising machines with money simplest cost might be an increasing number of unusable by way of nearly all of the inhabitants.

How can firms, akin to Vianet Smart Machines, allow you to to take pleasure in this alteration in client behaviour and the death of arduous money

Vianet Smart Machines supplies an cutting edge finish to finish contactless cost answer for automatic retail, merchandising and self-service machines.

Whilst contactless cost provides customers a blank, versatile and occasional possibility cost choice, the convenience for distributors of utilising this era can’t be understated for the reason that machines provided with contactless cost frequently revel in greater gross sales, with corresponding enlargement in gadget profitability and critical development in working cashflow.

Managing director of Smart Machines, Rob Little mentioned: “Make no mistake, this pandemic is a serious wake-up call for an industry dependent on cash payment. The consequences are stark in that we are now faced with the possibility of business viability being challenged by too few consumers carrying cash and too many machines not equipped to accept any form of payment other than cash. If that is not a challenging enough prognosis, when many operators required cash to survive this crisis it was locked inside machines in customer premises that could not be accessed. Given that scientific experts are forecasting further outbreaks of the virus in winter and beyond, it is critical that vendors are as prepared as possible for that scenario. The industry solution lies in adapting rapidly to this powerful shift in consumer behaviour and mitigating the threat of future outbreaks by equipping vending machines with contactless payment capability”

The merchandising business has massive attainable to thrive from this pandemic by way of responding undoubtedly to converting client behaviour. Contactless cost will play a pivotal position in that reaction because it advantages each the shopper and the seller. Put merely, there’s no problem possibility, and with the money from contactless transactions to be had for your financial institution in a question of days, that may simplest imply a more potent and extra tough trade.

What do Vianet Smart Machines shoppers say?

JW Vending are testomony to the revolution of contactless cost within the merchandising business and the luck of Vianet’s Smart Machines answer. JW Vending’s Chris Worgan mentioned: “We have been using Vianet for nearly four years. Their product has been invaluable to us and we are seeing enormous gains as contactless payments continue to rise dramatically. In the last four months alone we have seen a complete sea-change in payment – with almost two thirds of our sales now being made through contactless transactions. On top of this, we have been consistently impressed by their exceptional customer service and knowledgeable representatives.”

Vianet be offering san finish to finish answer providing each knowledge verbal exchange and contactless cost, with their Smart Machines merchandise together with their vitel NANO telemetry instrument, that operates along side Vianet services and products to offer real-time control of Smart Machines. This extracts knowledge electronically from the gadget controller and transfers this information at common periods to Vianet hosts machine by means of a cellular community connection developing customer-specific studies can then be seen over a safe web internet web site. vitel

NANO telemetry instrument, that operates along side Vianet services and products to offer real-time control of Smart Machines. This extracts knowledge electronically from the gadget controller and transfers this information at common periods to Vianet hosts machine by means of a cellular community connection developing customer-specific studies can then be seen over a safe web internet web site. vitel NANO helps operation as an MDB Cashless System working in solidarity with the Vianet Contactless cost answer.

NANO helps operation as an MDB Cashless System working in solidarity with the Vianet Contactless cost answer.

With their very own in-house engineering and give a boost to workforce, arrange and set up of those merchandise into present merchandising machines, in addition to new machines couldn’t be more uncomplicated. The contactless cost answer is appropriate with all main merchandising gadget producers and is a PCI permitted answer offering safe coverage of the operator and visitor’s cash and card holder knowledge.